At Lass Law, we believe divorce is not the destination-it's a path to the other side of something better waiting for you.

Proven Legal Representation

Our experienced legal team offers a comprehensive suite of legal services designed to meet the diverse needs of our clients.

-

Child Support

Child Support -

Divorce

Divorce -

Child Custody

Child Custody -

Domestic Violence

Domestic Violence -

Postnuptial Agreements

Postnuptial Agreements -

Annulment

Annulment -

Cohabitation Agreements

Cohabitation Agreements -

Custody & Support Enforcement

Custody & Support Enforcement -

Custody & Support Modification

Custody & Support Modification -

Prenuptial Agreements

Prenuptial Agreements -

Divorce Mediation

Divorce Mediation -

Divorce With Children

Divorce With Children -

High Net Worth Divorce

High Net Worth Divorce -

Marital Settlement Agreements

Marital Settlement Agreements -

Military Divorce

Military Divorce -

Property Division

Property Division -

Same Sex Divorce

Same Sex Divorce -

Spousal Support

Spousal Support

Why Choose Lass Law?

-

Experience and ExpertiseAt Lass Law, our team combines decades of focused experience in divorce and family law to guide you through even the most complex matters. Whether it’s high-net-worth asset division, military divorce, child custody disputes, or mediation, our attorneys have the track record, legal knowledge, and courtroom skills to advocate for your interests effectively.

-

Client-Centered ApproachYour case is about more than statutes and court filings — it’s about your life, your family, and your future. At Lass Law, we build relationships grounded in trust and understanding. From the first consultation onward, we take time to learn your priorities, assess your situation holistically, and tailor our legal strategy to your goals.

-

Personal AttentionYou won’t be handed off to an assistant or treated like a number. At Lass Law, our attorneys stay directly involved from strategy through resolution. We maintain open, honest communication — explaining legal options in plain language, keeping you updated on developments, and remaining accessible when you need us most.

-

Results-Driven AdvocacyWe don’t just file motions — we pursue outcomes that protect your rights, assets, and family’s well-being. Whether negotiating settlements or litigating contested issues, we leverage tenacity, creativity, and deep familiarity with local courts to secure resolutions that support your long-term best interests.

Our Experienced Legal Team

Our success is driven by the dedication and talent of our exceptional legal team. Each member brings a unique set of skills and experiences to the table to meet your needs.

-

Amy LassOwner & Certified Family Law Specialist

Amy LassOwner & Certified Family Law Specialist -

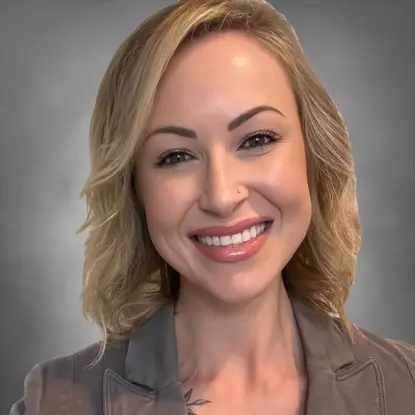

Brooke MusickDirector of Operations & Certified Divorce Coach

Brooke MusickDirector of Operations & Certified Divorce Coach -

Moonazza “Mona” NaqviSenior Attorney

Moonazza “Mona” NaqviSenior Attorney -

Eiman RejaliOf Counsel

Eiman RejaliOf Counsel -

Jessica MertesAssociate Attorney

Jessica MertesAssociate Attorney -

Mekyla RobinsonAssociate Attorney

Mekyla RobinsonAssociate Attorney -

Brittany Van RyderAssociate Attorney

Brittany Van RyderAssociate Attorney -

Paige NadeauLaw Clerk

Paige NadeauLaw Clerk -

Gina MichelSenior Paralegal

Gina MichelSenior Paralegal -

Allison HugoParalegal

Allison HugoParalegal -

Sarah NewhouseParalegal

Sarah NewhouseParalegal -

Ashley StovallParalegal

Ashley StovallParalegal -

Beth SassowerClient Concierge & Legal Assistant

Beth SassowerClient Concierge & Legal Assistant

Our Values

-

Integrity FirstWe believe trust begins with honesty. At Lass Law, we provide clear, straightforward advice and transparent communication so you always know where your case stands. Integrity guides every decision we make on your behalf.

-

Justice Through AdvocacyWe stand firm in protecting your rights and pursuing fair outcomes in every family law matter. Whether through negotiation or litigation, our attorneys advocate passionately to secure results that serve your best interests and those of your family.

-

Dedication to ResultsWe are committed to achieving resolutions that bring stability and peace of mind. With strategic focus and compassionate representation, Lass Law works tirelessly to help you move forward with confidence and a stronger future.

What to Expect

-

Personalized Legal Guidance

At Lass Law, every case begins with understanding your story. From the first consultation, we take time to learn your goals, family dynamics, and priorities. There are no one-size-fits-all solutions — our strategies are tailored to your circumstances, whether your case involves complex asset division, custody arrangements, or support issues. You can expect thoughtful, strategic, and compassionate legal guidance every step of the way.

Contact Us -

Guidance Every Step of the WayNavigating divorce and family law can feel overwhelming. At Lass Law, we make the process clear and manageable. You’ll receive transparent communication, regular updates, and plain-language explanations of your options. Our team stands beside you through every stage, ensuring you always know what to expect and that your choices align with your long-term goals.Contact Us

-

Representation in CourtWhile many family law matters are resolved through mediation or settlement, Lass Law is fully prepared to litigate when necessary. Our attorneys are skilled advocates with extensive courtroom experience, ready to protect your rights and secure fair outcomes. When you choose Lass Law, you choose a firm committed to your future — with integrity, strength, and unwavering dedication.Contact Us

Call Today to Consult a Carlsbad Family Law Attorney

We understand how deeply divorce and family law issues can impact you, your children, your financial stability, and countless other aspects of your life in the future. We take the time to understand your unique family dynamics, needs, and goals to help you achieve meaningful, optimal resolutions.

We serve the counties of San Diego, Orange, Riverside, San Bernardino, and Los Angeles.

Call (760) 474-3861 or reach us online to request your confidential case review with one of our family lawyers today.

Our Service Areas

- Orange County

- Riverside County

- San Bernardino County

- San Diego County

Frequently Asked Questions

We understand that seeking legal representation can raise various questions. Below are some of the most frequently asked questions we get.

-

Distribution laws. Community property states divide marital assets equally, while equitable distribution states divide assets fairly but not necessarily equally, based on factors like each spouse’s contributions, earning potential, and financial needs.

-

To modify a custody or support order, you must file a petition with the court that issued the original order. You’ll need to demonstrate a significant change in circumstances, such as a job loss, relocation, or changes in the child’s needs, to justify the modification.

-

Yes, in many states, grandparents can petition for visitation rights. The court will evaluate the nature of the relationship, the child’s best interests, and whether visitation will provide emotional and psychological benefits to the child. However, parental rights typically take precedence.

-

Child support is calculated based on state-specific guidelines that consider factors such as each parent’s income, the number of children, custody arrangements, and the child’s specific needs. Courts may also factor in healthcare costs, childcare expenses, and educational needs when determining the payment amount.

-

Legal custody refers to the authority to make major decisions about a child’s life, such as education, healthcare, and religious upbringing. Physical custody determines where the child lives and who is responsible for their day-to-day care. Both can be shared (joint custody) or awarded to one parent (sole custody), depending on what the court deems to be in the child’s best interests.

Client Testimonials

Our clients' satisfaction is at the heart of everything we do. We are proud to have had the

opportunity to represent and assist numerous individuals.

-

“A big THANK YOU to Amy Lass and crew for efficiently gathering the loose ends and driving to an agreement my divorce that dragged on far too long prior to retaining Lass Law. Highly recommend!”- D.S.

-

“From the very beginning, she brought a calm, confident presence that immediately put me at ease during one of the most difficult times in my life.”- Stela M.

-

“Being happy after a divorce is rare. But here I am smiling ear to ear.”- Luke M.

-

“I have referred a significant number of people to Amy and Jess, and I always hear nothing but positive things. They are truly one of the best family law firms in the state.”- Liam P.

-

“A big THANK YOU to Amy Lass and crew for efficiently gathering the loose ends and driving to an agreement my divorce that dragged on far too long prior to retaining Lass Law. Highly recommend!”- Douglas S.

-

“Amy and her team are the best!”- Mallory M.

-

“I would trust her and her team again in the things that matter most to me, without hesitation.”- Timothy A.

-

“They delivered results and did it with integrity. I’m thrilled Lass Law settled my case — waking up the next morning and not calling Lass Law felt like freedom.”- Natalie H.

-

“Amy and her entire staff, especially Brooke, exemplify professionalism at the highest level. They are consistently punctual, detail-oriented, and highly responsive, which makes a meaningful difference in complex legal matters.- Tonya J.

”

.png.2601211328034.webp)